Evers Vetoes Middle-Class Tax Cuts

Last week, Governor Evers used his line-item veto power to eliminate 95% of the income tax cut passed by the Republican Legislature just a week prior. Unfortunately, the majority of his veto falls on Wisconsin’s middle class. Because of the Governor’s veto, individual filers making above $27,000 a year or families making at least $36,000 a year are no longer eligible for significant tax relief. At a time of rising inflation and economic uncertainty for many Wisconsinites, it’s more important than ever that we return to taxpayers more of their hard-earned money. I will continue to recognize the fact that hardworking Wisconsinites know how to spend their money more wisely than the government does. Throughout the remainder of this session, I will be introducing a number of proposals focused on reducing the tax burden in our state.

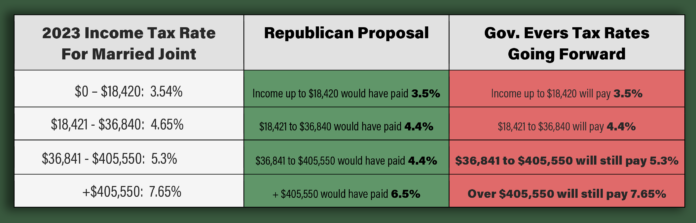

The chart above shows the Republican proposal compared to the budget Evers signed. Our proposal would have collapsed and lowered the two middle brackets to a flat rate of 4.4%, and reduced the top rate to 6.5% – a move that would have provided $537 in relief for the average filer. These changes would have benefited every Wisconsin taxpayer and helped us compete with our more taxpayer-friendly neighboring states. Instead, Governor Evers chose to keep the middle-class tax rate at 5.3% and the top tax rate at 7.65%. Now, the average filer will see just $36 in relief. Wisconsin will continue to have a higher top tax rate than most of its neighbors, including Illinois.

In addition to eliminating $2.7 billion in tax cuts, Governor Evers used his veto pen to open the door for property tax increases for the next 400 years. To learn how his change to the school funding structure could affect property taxpayers for the next four centuries, read this article by the Wisconsin Institute for Law and Liberty.

The implications of the Governor’s vetoes are grave for Wisconsin taxpayers. As your state legislator, I will continue to fight for ways to return more of your money back to you, despite Governor Evers’ attempts to keep it.

Contact Me

My office is always available to help with any state-related questions or concerns you may have. You can reach my office at (608) 237-9104, or email me at Rep.Steffen@legis.wisconsin.