Enrollment

Total enrollment in 2022 is 14,491. The Appleton Area School District serves nearly 15,000 students in fifteen elementary schools, four middle schools, three high schools, thirteen Charter schools, and one magnet school.

Student Achievement

The Appleton Area School District’s latest annual “report card,” a 10-page report produced by the Wisconsin Department of Public Instruction, can be found here:

https://www.aasd.k12.wi.us/common/pages/DisplayFile.aspx?itemId=14440741

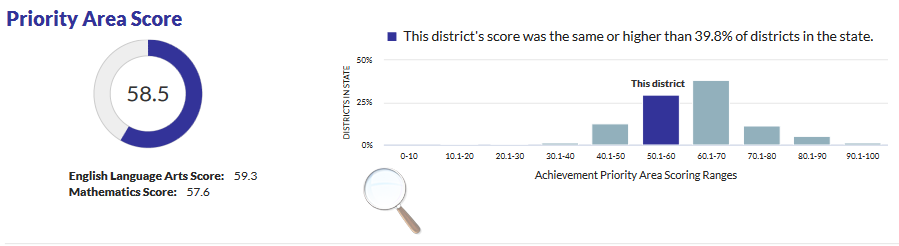

The most important graphic in the latest (2021-2022) report card is the following:

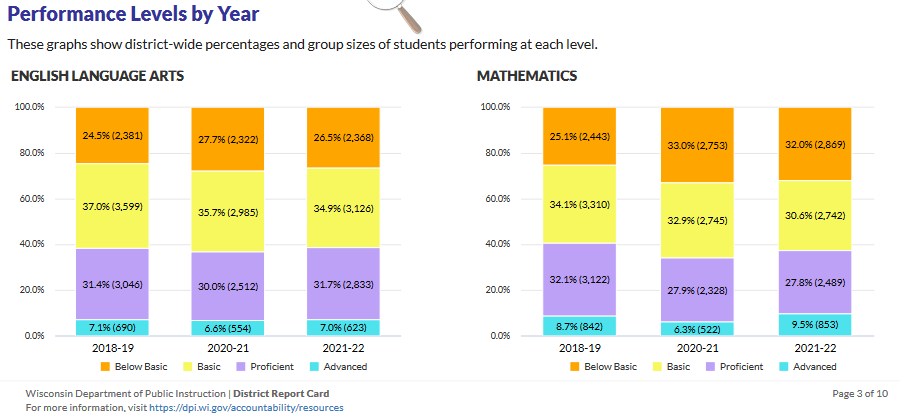

In other words, average weighted student achievement in the Appleton Area School District was below the statewide average in 2021-2022. The following graphic shows the percentage of students whose achievement on the state assessment of English language arts and mathematics skills are “below basic,” “basic,” “proficient,” and “advanced.”

2022-2023 Budget

The 2022-2023 fiscal year budget for the Appleton Area School District, less inter-fund transfers, is $243,984,990. Per-pupil spending is $16,837.

The full budget can be found here:

The June 2021 annual financial report can be found here:

https://www.aasd.k12.wi.us/common/pages/DisplayFile.aspx?itemId=14144763

Budget highlights for 2022-2023, as reported by the District:

- The second year of the bi-annual state budget again had no increase in the per student revenue allocation from the State. We will not see an increase in our Revenue Limit authority for the third straight year. We will continue to get a “Declining Enrollment Exemption” and a “Hold Harmless Exemption” as part of the revenue limit formula. These exemptions will help offset the loss of revenue we would have seen due to our declining membership. Because of these factors, we are budgeting for a $2 million decrease in revenue compared to last year.

- We have an increase in our open enrollment in this year and a slight decline in our open enrollment out. This net effect of an additional 959 students has a positive impact through open enrollment funding.

- Due to having no change in our revenue limit authority, and an increase in state aid, the funding we receive from local property taxes will also see a decrease. However, the amount the AASD is required to levy to fund private school vouchers will increase from last year’s total of $4,520,772 to $ 5,612,335. Private school vouchers will make up $.53 of our tax rate, or the equivalent of $53 on $100,000 of property.

- To offset these decreases we have received additional state funding through the Governor’s “Get Kids Ahead” initiative again this year. We also will continue to use the funds available from the Federal government through the American Rescue Plan (often referred to as ESSER funding). The full amount of this revenue will be spent mitigating the disruption to student learning caused by the pandemic.

- The 2022-2023 fiscal year finished with a surplus of approximately $8.8 million. With no increase in revenue, this surplus will allow the district to cover operational increases that are caused by inflation. The most significant operational increases are; compensation increases, health insurance, cleaning costs, transportation, technology contracts, maintenance contracts, and utilities.

- Staffing changes will have an effect on our 2022-2023 budget. Our overall staffing will decrease by 1.3%, with the largest decrease in ESSER supported positions as we no longer have the dedicated health room staff at each school.

- Compensation increases for 2022-2023 were approved earlier in the year for all staff, at an average increase of 3.63% for all employee groups. The Consumer Price Index (CPI) for districts was set this year at 4.7%.

- Fund 80, our Community Service Fund will see an increase in the tax levy of 5.6% this year to keep pace with the increases in expenses of the Fund. This Fund continues to carry an appropriate positive fund balance at about 23.7%.

- The District paid off the remaining Fund 38 debt in 2021-2022. The District again paid down additional long-term referendum debt (Fund 39) during 2021-2022. Leaving the remaining balance of Fund 39 debt at $6,360,000. It is budgeted for 2022-2023 to pay this remaining debt off in full.

- The District has two referendum questions on the ballot for the November 8, 2022 election. The 2022-2023 proposed budget includes $8.7 million in tax levy (Fund 39) for future payment of this debt if these referendum questions are passed.

- The District’s Equalized Property Value increased by 10.51% from just under $9.5 billion last year to nearly $10.5 billion this year. This increase means our tax levy will be dispersed across more property value thus driving down the mil rate.

- Our tax rate, often referred to as our mil rate, is projected to decrease from $7.66 per $1,000 of equalized valuation to $7.10 per $1,000 of equalized valuation. 2022-2023 will be the ninth straight year in which the Appleton Area School District has had a decrease in our tax rate.

A Thought Experiment

What if the tax dollars currently raised to fund a child’s education in a public school in Appleton, about $16,800, was instead given to parents in the form of a voucher to be used only to pay for tuition and other educational expenses of their child? Imagine that three teachers started their own small school and enrolled just 21 students. Their annual budget would be $16,800 x 21 = $352,800. If they paid themselves $90,000 a year — generous compensation for a job that offers 15 weeks of vacation! — they would still have nearly $7,000 a month ($82,800) left to pay for rent, utilities, insurance, etc. Its student-teacher ratio would be 3:1! Would you send your child to that school?