The Appleton City Budget for 2023, all 691 pages of it, can be found here. Links to budgets dating back to 2010 can be found here.

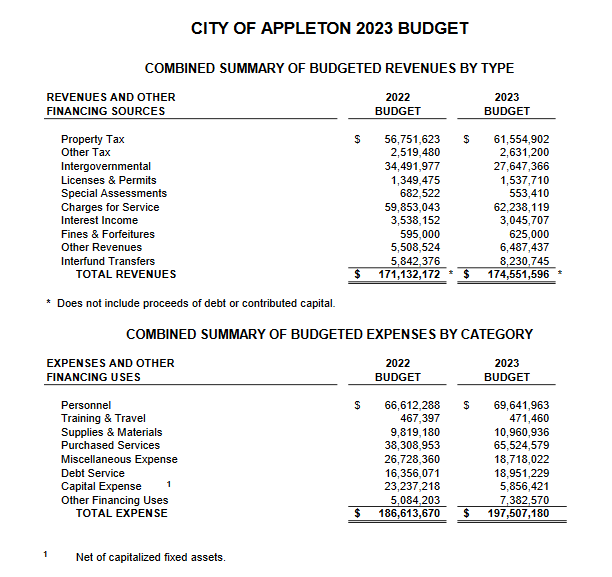

In 2023, the City of Appleton planned to raise approximately $174 million in revenues and spend approximately $197 million. A summary of the 2022 actual budget and the approved budget for 2023 appears below.

In the Mayor’s 2023 Budget Message, Mayor Woodford expressed serious concern about the impact of record levels of inflation, which he put at about 8%, on the city’s finances. “As an employer of over 640 full time staff and hundreds more seasonal and part time employees,” he wrote, “the City of Appleton has also faced increasing wage pressure. Competition among municipalities, and even across sectors, has presented challenges in retaining current, and recruiting new, employees.” He said, “the leadership team has worked to reallocate funds internally to support a recommended 5 percent merit-based increase for non-represented employees.”

Also in his budget message, Mayor Woodford presented the following overview of budget activity across the major sections of the budget:

- General fund revenues and expenditures both totaled $68,946,539 in the 2023 Budget, an increase of $2,738,084 or 4.13%. The revenue increase is attributable mainly to the allowable increase in the property tax levy along with the closing of TIF #6.

- The general fund tax levy increased $744,720, or 2.00%, to $37,824,720 in the 2023 Budget. At the same time, the tax levy for debt service increased $2,563,397, or 23.6%, to $13,437,688. Overall, the tax levy for the City is expected to increase $3,308,117, or 6.61% in 2023. This increase is within State-imposed levy limits.

- Tax Rates – The City’s equalized value increased 12.31% to $7,511,516,400 in 2022. The City’s estimated assessed values are projected to grow a more modest 0.40%. Applying the 2022 total estimated assessed value (excluding TIDs) of $5,630,285,174 to the tax levy results in the following projected assessed tax rates:

- Outagamie County – $9.48, an increase of 58 cents, or 6.56%

- Calumet County – $9.46, an increase of 35 cents, or 3.79%

- Winnebago County – $9.24, an increase of 49 cents, or 5.60%

On an equalized value basis, the tax rate is projected to be $7.52, a decrease of 34 cents, or 4.27%.