Over the past two years, the Appleton Concerned Taxpayers group has lobbied local state representatives and senators for help in correcting problems with state shared revenue. On March 11, we attended the Listening Session hosted by State Senator Rachael Cabral-Guevara (19th District) and State Representatives Dave Murphy (57th District) and Nate Gustafson (55th District). Below is part of the message we have been sharing.

Problem

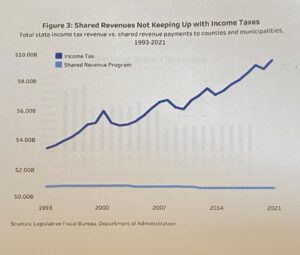

Since 1993, Wisconsin State Revenues have jumped almost 200%. During this same period of time, Wisconsin Shared Revenues have flatlined. Municipalities and their property taxpayers have suffered.

Inflation topped 30% (not including the 2022 rate of 8.7%) while the city tax levy has increased 39%. Appleton’s Debt Service from General Funds has skyrocketed from 4.2% to 35.6% of funds, forcing Appleton to push back projects such as replacement of substandard/outdated 4” and 6” water pipes due to lack of funds, with water main repair costs close to a million dollars each year. Infrastructure extensions have been delayed from 2022 to 2025 or later, slowing city growth.

Possible Solutions

- A one-time “catch up” lump sum be distributed in an equitable way to counties and municipalities.

- With Wisconsin harboring an expected $7+ billion in surplus money, an immediate increase in disbursements to include a 30% increase (using 2011 figures) in state shared revenues, tying future shared dollars to the rate of inflation.

- Stipulations fixing any lump sum payments to cities, municipalities and counties be limited to infrastructure: roads, water lines, sidewalks or broadband.

- Incentivize areas experiencing large percentages of General Funds going to debt service to rein in costs to a predetermined level with the lure of an extra percentage increase in shared revenue via a specific figure bonus or percentage of sales tax revenue.

It is time for our state government to truly help the local taxpayers of Wisconsin. Lowering state taxes does nothing if cities, counties, schools and municipalities simply increase them, often escalating them, placing a greater burden on the taxpayer. Although the headline “Wisconsin lowers State Taxes” looks good, we would prefer “Wisconsin Lowers Statewide Tax Burden.”

The representatives at this Listening Session were optimistic that relief was on the way. Fairness and sustainability were cited as issues for discussion at this time. If you wish to weigh in on this issue or others, local representatives’ contact information can be found here:

Rachael Cabral-Guevara, State Senator District 19

Email: Sen.Cabral-Guevara@legis.wisconsin.gov Phone: 608-266-0718

Nate Gustafson, State Representative District 55

Email: Rep.Gustafson@legis.wisconsin.gov Phone: 608-237-9155 or 888-534-0055

David Murphy, State Representative District 56

Email: Rep.Murphy@legis.wisconsin.gov Phone: 608-237-9156 or 888-534-0056

Lee Snodgrass, State Representative District 57

Email: Rep.Snodgrass@legis.wisconsin.gov

Phone: 608-237-9157 or 608-534-0057